A quiet pullback before the big decision

A quiet pullback before the big decision

I. Headlines and Catalysts

The market opened the week on the back foot. The Nasdaq Composite slipped as traders eased back into their desks, keeping one eye on Wednesday’s FOMC decision and the other on the latest tech drama.

Last week’s mix of flat inflation and weak labor data only firmed expectations that the Fed is ready for its third and likely final 25bp cut. With so much riding on Wednesday, price action felt cautious rather than fearful.

The news cycle was anything but calm. Media and streaming names stole the show as Netflix, Warner Bros, Paramount, and Skydance continued their corporate tango. PSKY’s raised offer for WBD set off a fresh round of speculation.

Then came the late-day spark: Trump posted that Nvidia will be allowed to ship H200 chips to China for a 25 percent export fee. Nvidia backed the message, but the company has not reported any sales of its export-friendly H20 chips for two quarters. The Chinese market has been slow to adopt US chips, but Jensen Huang still sees a fifty billion dollar revenue opportunity if the doors truly open.

The day ended with a small red candle, and a market that felt like it was simply holding its breath.

II. Sector Performance Snapshot

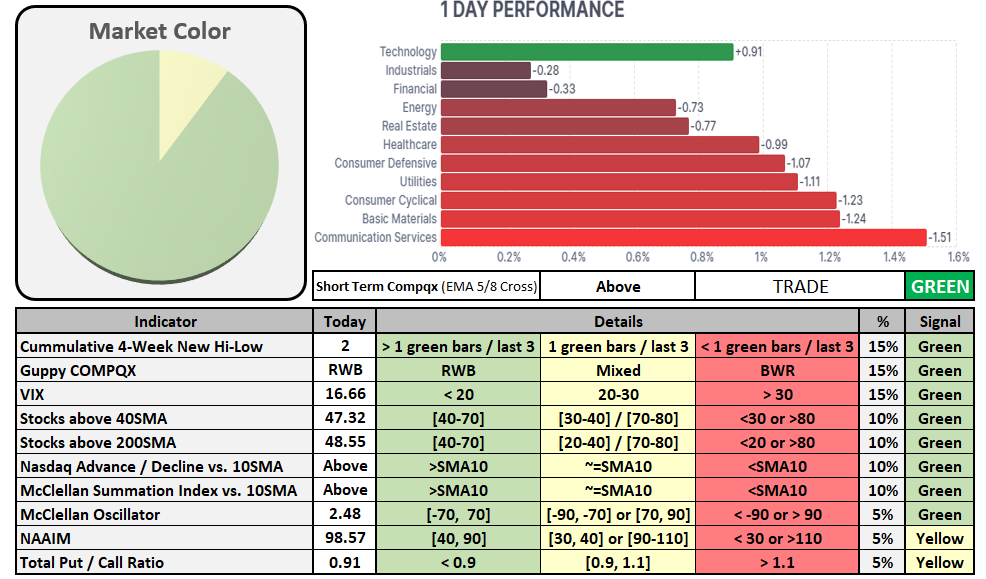

Sector action reflected a rotation under the surface:

Green: Industrials, Financials, Health Care. These groups saw steady flows, aligning well with Yardeni’s new recommendation to move away from mega-cap tech.

Flat to mixed: Consumer Discretionary and Energy.

Red: Tech and Communication Services, weighed down by the media consolidation headlines and the Mag 7 softening.

The tone was not bearish, just hesitant. Defensive strength showed up quietly.

III. Technical Breadth and Sentiment Check

Breadth leaned soft. Advancers lagged decliners on both the NYSE and Nasdaq, while new highs pulled back. Volume was light, consistent with a market waiting for clarity rather than reacting to it.

The chart of the Nasdaq Composite shows price knocking again on the same horizontal resistance from November, but the index closed under it. Until buyers decide to push through, the market remains in a holding pattern.

Sentiment measures were mixed:

The put-call ratio hovered near neutral.

VIX stayed muted.

AAII readings continue to show moderate optimism.

NAAIM exposure has cooled but remains above the midpoint.

Traders seem confident but not aggressive.

IV. Earnings and Corporate News

Netflix slipped after a downgrade tied to the Warner Bros acquisition uncertainty.

Carvana jumped after being added to the S&P 500.

PepsiCo got attention for its supply chain overhaul aimed at settling issues with activist investor Elliott.

PSKY led the S&P 6500 higher after its raised bid for WBD.

WBD climbed while Netflix fell, reflecting shifting expectations around the bidding landscape.

Small caps were active again on retail trading platforms. After last week’s SMX spike and crash, traders hunted for similar short-term setups across the lower end of the market.

Ed Yardeni made waves by officially ending his fifteen-year overweight call on mega-cap tech. He now recommends lifting exposure to Industrials, Financials, and Health Care while reducing reliance on the Mag 7. Despite this shift, he still expects the “Roaring 2020s” to continue and even raised his S&P 500 target to 7,700 for next year.

V. Economic Calendar Highlights

A busy slate is lined up:

ADP Employment Change (8:15 AM)

Nonfarm Productivity Q3 (8:30 AM)

JOLTS Job Openings (10:00 AM)

Pre-Market Earnings: AutoZone

After-Market Earnings: GameStop, Dave & Buster’s, AeroVironment

All of this leads straight into the FOMC on Wednesday.

VI. Interpretation and Outlook

The market is not ready to commit until the Fed speaks. Tech softened. Rotation continued quietly. Breadth dipped but did not deteriorate. The index held support and stopped under resistance, matching the cautious tone.

If the Fed confirms a final cut and signals a pause, markets may get the clarity they’ve been waiting for. If the message is muddled, we may see more hesitation. For now, traders appear content to wait rather than guess.

VII. What to trade today

The index is still under resistance, and the move from last week is losing speed. I prefer to avoid adding size into uncertainty. If the pullback stays controlled and volume remains light, I will look for strength after the Fed meeting.

Sectors like Industrials, Financials, and Health Care continue to show relative power, so I keep these on my radar. Tech is still the long-term leader, but I do not feel the need to chase until the picture becomes clearer.