The United States Investing Championship is a real money verified competition that allows up-and-coming traders to showcase their talent on the world stage.

Prior top performers include Paul Tudor Jones and Louis Bacon. Participants specify an account number at the beginning of the year for tracking purposes. Brokerage statements associated with that account are used to verify performance claims. The competition began in 1983 and ran for fifteen years. It was restarted in 2019.

The top finisher in the $1,000,000+ stock division is Mark Minervini, + 334.8%.

Mark Minervini is a technical analyst, acclaimed author, instructor, and independent trader. He is considered one of America’s most successful stock traders; a veteran of Wall Street for more than 37 years. He is the author of the best-selling books Trade Like a Stock Market Wizard and Think and Trade Like a Champion. Mark is featured in Momentum Masters — A Roundtable Interview with Super Traders and in Jack Schwager’s Stock Market Wizards: Interviews with America’s Top Stock Traders.

Schwager wrote: “Minervini’s performance has been nothing short of astounding. Most traders and money managers would be delighted to have Minervini’s worst year — a 128 percent gain — as their best. His average annual return has been a towering 220 percent, including his 155 percent first-place finish in the 1997 U.S. Investing Championship. But the return is only half the story. Amazingly, Minervini achieved his lofty gains while keeping his risk very low: He had only one down quarter — barely — a loss of a fraction of 1 percent.

Specific Entry Point Analysis® — SEPA® is a highly disciplined stock trading strategy developed by Mark Minervini. The methodology’s foundation is built upon the historical precedent analysis of past stock market “Superperformers.”

The SEPA® strategy focuses on identifying, company-by-company, the precursors of inefficient pricing to distinguish appropriate low-risk/high-reward entry points. Utilizing SEPA®, stocks displaying the potential for significant price appreciation are identified and pinpointed. This proven technology consistently highlights many of the best investment ideas and stock market leaders before they’re widely recognized by Wall Street.

The most famous signature trading tips are: wait for VCP (volatility contraction pattern) to develop in a stock price evolution and identify the cheat, an earlier entry in the “cup and handle” pattern formation.

I am very honored and humbled that Mark Minervini noticed this article on Twitter and recommend it. Thank you very much!

If you are passionate about trading you may subscribe to my newsletter or follow me on Twitter.

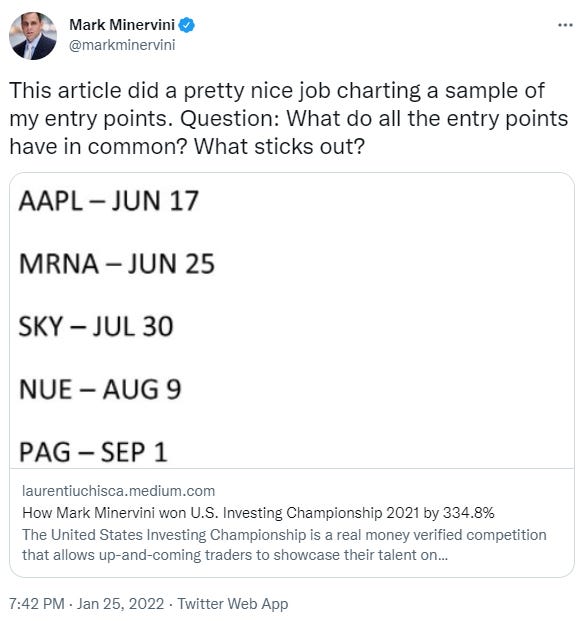

During last year’s contest, Mark traded stocks using his signature method and proved again he is a real champion. He provided a sample for his trades: the ticker and the entry date:

There is no additional info regarding the exact entry, exits, or position sizes. Based on the data provided, I will analyze the trades. Of course, from now on, there are only my assumptions.

Even if in practice each position is managed based on all the data available at that moment, please consider that the trades management presented here is for sure different than the real Mark Minervini's approach.

Definitely, there are trades that have been placed earlier (when noticing the bound from an average or when relative volumes came in) or even later than shown here. The same for exits: there might have been trades sold in the strength or closed partially earlier to protect the capital and minimize the risk.

Taking all these into account, here are the trades:

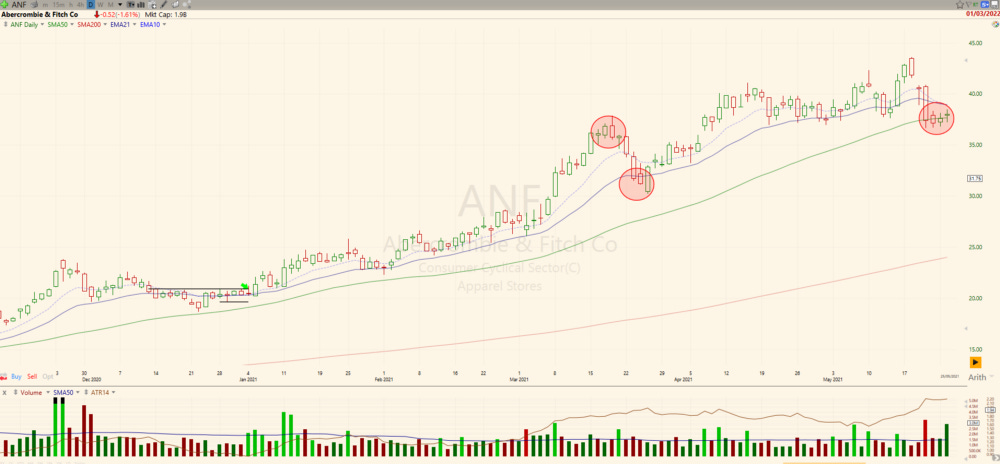

$ANF - January 4

On the first day of the year, Mark bought Abercrombie & Fitch Co ($ANF) which was constructively consolidating very close to the EMA21 and even SMA50. The volumes were well under the average, while the Average True Range (ATR) was decreasing. But during this day, the volumes were double than the previous day. I do not have the exact entry price, but based on the strategies described in his books, I think he bought over the previous day high ($20.94) with a Stop Loss at $19.64. This is a 6.21% risk trade. During the competition, he might have been used only half of the mentioned risk. Of course, the trend is in place, all moving averages are one above the other in the desired order (the small ones above the bigger ones). SMA200 was up for a month and the price doubled in the last 6 months. The recent correction was around 20%.

If he used the SMA 50 as a trailing stop, he probably run the trade until $37.5, a 79% trade! Definitely, there were partials along the road, probably when the price was extended. On the graph, there are other possible partial exits. As already stated, there must have been other ideas as well on the way up.

$GM - January 11

A few days later, Mark bought General Motors ($GM) probably at $43.5 with a Stop Loss at $42.32 with just 2.71 risk! Again, all conditions are clear: trend in place, good volumes, ATR declining, ~12% correction, price very close to the EMA21 and SMA50. The price was acting very all two weeks before. Just one week before, there was a shakeout. But the following day buyers come in sending the price back in the EMA21 area. This is a very bullish sign, a “tennis ball action” (Mark gave an example in his book with a ball that is released when underwater). Then, a small flag with a normal retracement. Once rejected by the average and went above the previous candle, the price offered a low-risk entry.

Using the same possible idea of the exit, Mark probably closed the position at 56.22, a 29% trade.

$STAA - January 12

This is a classic entry above the ATH (all-time high). Again, many planets are aligned:

the trend is in place, all moving averages are in the right order

price held by SMA50 and then continued to use EMA21 as support

correction from the previous ATH: ~20%

nice-looking cup and handle pattern with VCP (volatility contracting pattern), higher lows

good volumes with buyers stepping in when price increases

Trade risk: 4.87%

On the breakout day, the volumes are doubled than the previous day signaling a big interest from buyers

After it failed to break the resistance at $128, the stock began its downside. After some selling into strength, more than sure the trade was closed between February end and the beginning of March.

$NNOX - January 20

$NNOX had a beautiful pattern, even a child could see it. Volatility contraction pattern at its best, volumes and ATR were very low signaling a solid friendship between sellers and buyers.

The stock price has tripled from the previous important base low and made a correction now of 40%.

The potential was very good associated with the risk (5.42%).

Immediately after the breakout, the price advanced rapidly and got extended from the averages offering a partial selling into strength opportunity. Other possible exits at EAM21 and SMA50 cross.

$UAVS - February 9

A similar entry for $UAVS. Good pattern for a diagonal breakout. What can be seen here is that there are a lot of accumulations (the big green skyscrapers bars), especially in December with very low volumes in selling. Basically, the ones that bought shares are keeping them. This is a very bullish sign if we take into consideration that the stock increased 7 times from its old long base.

The day after the breakout there is a huge topping tail: a good time to sell partially into strength. A few days succeeded to keep above the breakout point but then collapsed. Dan Zanger said that a racing horse never goes back to the starting point, so after the advance, it was a time to close the trade.

$MP - February 9

$MP was a stock mentioned many times in the media, but this was not the reason for the trade. It made a beautiful diagonal breakout while ATR and volume were decreasing.

The stock price found support at SMA50 and then at EMA21.

After 9 days there was a big shakeout that could close the trade. If the Stop Loss was not increased from the initial point, then there were three possibilities of partial exits: into strength, at EMA21 cross, and at SMA50 cross.

$GBOX - April 5

Another exceptional pattern at $GBOX: after a huge advance from the previous base, it makes a high with and corrects 45%. Then, ATR and volumes decrease and offer a very good risk-reward trade with just a 4.21% risk.

Again, the volatility contraction pattern is easily spotted while the price is finding support at EMA21.

As we noticed from the previous trades, the market was not in a stable uptrend and the best idea was to take partial profits as soon as the conditions are met. And this occasion came in the next two days. Another possible exit was at the breakeven/breakout point.

$YETI - April 6

$YETI was set up very well, with low volumes and decreasing ATR. EMA21 and SMA50 were very close, “forcing” the price to decide where to go. The possible entry was at the black line with Stop Loss at 72 (a 4.12% risk).

After buying, the price acted beautifully until the EMA 21 cross didn't offer reasons for partial selling. Then, after two weeks, there was a bull flag failed breakout and the price began to decrease. Once under the SMA50, there were no reasons to keep it.

$ZIM - April 8

$ZIM was the perfect new stock launched when the shipping cost increased all over the world. It had good momentum and attracted many traders. After a 50% advance, it offered a good pattern with VCP and low volumes. The risk was 5.82%.

It acted very well and besides soma possible selling into strengths, the stock might have been sold at EMA21 cross and/or SMA50 cross (especially when the resistance at $50 couldn't be broken).

$BNTX - June 2

$BNTX build a nice base after the recent high and came back as a tennis ball released underwater after the big drop. Good low volumes and ATR was decreasing in a very constructive way.

The entry was probably over the previous day high at a very similar level with ATH.

Again, these kinds of trades are very well played bar by bar. The market was not very helpful and selling into strength as soon as you can is a very good approach. Big topping tail, EMA21 cross, or even SMA50 cross are some key moments for selling.

$HSKA - June 4

$HSKA is another signature pattern of Mark Minervini: cheat, an earlier entry in the “cup and handle” pattern formation. Most of the planets are aligned: low volumes, decreasing ATR, VCP.

Even if it didn’t confirm immediately (generally good breakouts send the price above and keep it there), after a 3-day pause, the stock advanced beautifully.

Reasons for selling: closings under the EMA21 or SMA50 and of course selling into strength.

$TSP - June 8

A very recent IPP signaled that it wants to get out of the turbulence zone. The consolidation was screaming for a breakout and I think the indicators like low volumes and decreasing ATR are the most obvious here.

The price successfully stayed above the EMA21 for a few days and the risk was very low as well, only 3.38%.

Generally, an IPO is very risky, but when a pattern is so clear and simple, it might justify pulling the trigger.

It acred nice and the price was seeing new highs. Good opportunity for selling into strengths and/or when the big red bar on crossing EMA21.

$AAPL - June 17

$AAPL made bull flag as a cheat after the triple bottom. All inside in a cup and handle formation. Anyway, a good risk-reward trade as the Stop Loss could be put at $127.1 (meaning a 3% risk).

Good low volume and decreasing ATR.

Just a quick observation, EMA21 was under SMA50. Not bad as EMA21 was increasing and was about to cross the SMA50.

There were few good days with multiple possibilities for selling into strengths. Then, the price failed to go to new highs and broke down under SMA50.

$MRNA - June 25

$MRNA was getting a lot of positive news and when formed a good cup and handle, it signed its intentions to go higher. Good Stop Loss at $213.38 offering a risk of 3.81%. The trend in place, good low volumes.

One of the best advances, is good partial selling when the wide range bar with big volume (signaling a possible buyers capitulation). EMA21 and SMA50 cross might also have been alternatives of partial selling points.

$SKY - July 30

Wide range igniting from the EMA21, then a retracement with a buy above the high. The Stop Loss at the base of the big bar.

Very good volumes and decreasing ATR with good support at EMA21.

Just as an observation, a better entry was possible two days before with even lower risk.

The price advance a little bit and formed a new base in which it acted well. Even when the price decreased, buyers step in forming a bottoming tail (on October the 1st).

The long base was a very powerful catapult and sent the price into new highs. Being extended now, selling into strength might have been a very good solution. Or/and when the price crossed the main averages.

$NUE - August 9

The steel sector acted very well during the last year and $NUE doubled till June. After the correction, it made a cheat. It was a good opportunity to be bought at ~$106.54 during the day. Volumes were important at the breakout.

Most of the money was made by a “hit and run” approach. Tight Stop Losses and selling rapidly into strength were the key. Good selling when extended and under the main moving averages.

$PAG - September 1

Another classic cup and handle. This trade needed at least a 7.13% risk to be able to place it. A smaller Stop Loss would have been too tight and have closed the trade in the following days after the breakout and squat.

Again, another example of a trade advancing just for a few days. Hunting for higher targets by trying to have larger stops would have killed the trader.

$TSLA - September 24

Tesla consolidated very constructively and formed a beautiful cup and handle while displaying a Volatility Contraction Pattern.

This was a trade “from the manual”, low volumes, decreasing ATR, the trend in place, unbelievable advance from the last base (173%), and a good risk.

The price advanced very rapidly to new highs. Being now extended it was a good opportunity to put some money aside. Of course, knowing the market condition from November, selling the stock was a good idea.

$OLN - October 11

After an advance of 470% from the low of the previous base, $OLN was a magnet for the traders when it made such a good-looking pattern.

It stayed very well above the main averages while forming a Volatility Contraction Pattern.

The entry was probably at $50.24 with a Stop Loss at 48.41.

Selling into strength is not an easy task. When you see that your stock made you money, you hope it will make you more. But if this technique is not mastered well, this year would have been a nightmare. Of course, Mark Minervini's approach is always a lesson. His experience over 37 years cannot be acquired easily.

$ASYS - October 26

A cup and handle form a cheat in a much bigger cup and handle. Again, mostly all the planets are aligned: uptrend, low volumes, good pattern, declining ATR, and possibility to have a tight Stop Loss for a low-risk entry.

A big wide range bar occur after two days and formed a bull flag. The stock price failed to break out again and sellers came in. The solution, again, selling into strength. There was a possibility to be caught in the gap-down. If the case, on that day, the position must be definitely closed.

$UPST - October 12

This stock had exceptional financial statements. All the dips were bought by investors during the year. And when a pattern was available, traders joined the party.

The impeccable trend and the good volumes ignited a breakout above the small consolidation.

A deja-vu: the importance of selling into strength when there is a big topping tail and jump from the train decrease with big volumes.

$NVDA short - December 3

The market was very weak. November was screaming about the number of stocks above the SMA200 and the new highs in Nasdaq! This big divergence signaled an uncommon situation from Spring 2021. After the growth stock that capitulated before the indexes, now it was the time for blue chips to capitulate too.

Mark Minervini shorted $NVDA after being unable to reach new highs and broke the created support.

Since the contest was ending last year, the trade might have been closed. But, in reality, the short position is in deep money now.

CONCLUSION

There are many lessons from Mark Minervini's trade samples. For me, and I know I am subjective now, the key lessons were:

Selling into strength was the main lesson. The market was very difficult for a long time trading. There were just a few trades with many months' positions.

Patience: Waiting for the right conditions pay. Just pull the trigger when conditions are met (right trend market, good pattern, Stop Loss at perfect support to be able to initiate low-risk entries). As per my simulations, Mark Minervini's risk was 4.9%. No trades in March, May, and November (as per sample trades).

The trades were placed at an average of 8% from the recent high.

Distance from the averages: again, based on my simulations, Mark Minervini trades at an average of 5% distance from EMA21 and 10% from SMA50. Of course, the lower, the better.

The previous advance for the traded stocks was 177% (average - measured from the low of the previous base until the recent high). A stock that doubled or even tripled in the last months has many chances to advance even higher from a new base.

The recent average correction for the traded stock was 29%. There is a sweet spot between 20 and 35%.

Not all the stocks presented all the best characteristics. Trading is not an exact science, but an art. Experience matters. Mark Minervini bought when:

the trend was technically up (90%)

volumes were lower and lower (90%)

ATR was decreasing (76%)

stocks had a Volatility Contraction Pattern (57%).

Here are some statistics:

Hello, I have calculated the RS Ranking for most of these trades, and I do not see that they are above the 75th percentile, I have calculated it with respect to the $SPX, the sector and industry and in all 3 cases, some trades are not above the 75th percentile. Is that okay?