Tech Stocks Up, Rest of the Market Down After Inflation Surprise

AI chips soar while inflation ticks higher and banks deliver mixed earnings

I. Headlines & Catalysts

Markets were mixed Tuesday as inflation data showed a modest surprise. Gapped up, but giving up almost all the gains by the close. A test of the breakout point area might happen.

The Consumer Price Index rose 2.7% year-over-year in June, slightly higher than forecast, raising concerns this might be the first tariff-related bump. Still, core inflation eased, calming some fears.

Meanwhile, President Trump struck a new trade deal with Indonesia, dialing tariffs down to 19% on key goods. While still unconfirmed by Indonesia, the move was seen as a de-escalation.

AI exports stole the spotlight: Nvidia and AMD jumped after announcing resumed or new chip sales to China, pushing tech sharply higher.

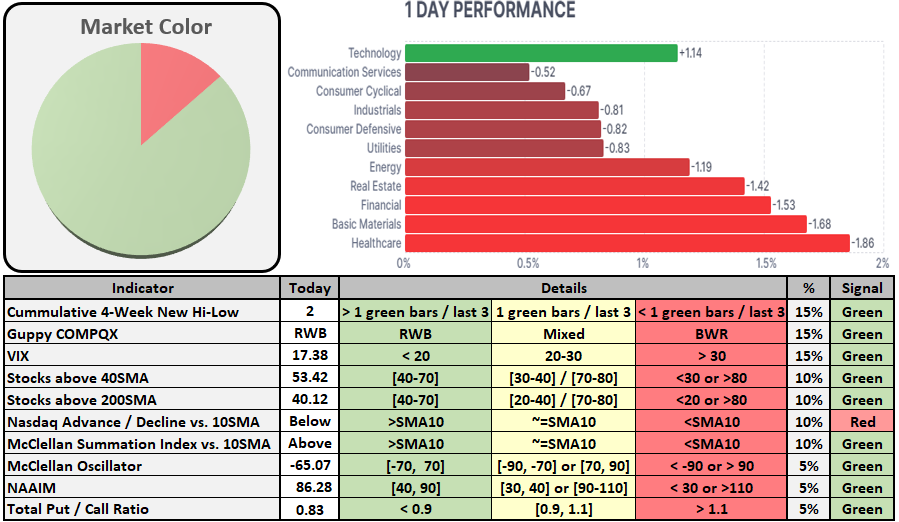

II. Sector Performance Snapshot

It was a tech-led day with only one sector in green:

🟩 Technology: +1.14%

🟥 Biggest laggards:

Healthcare (–1.86%)

Financials (–1.53%)

Basic Materials (–1.68%)

Real Estate, Energy, Utilities all down >1%

Theme: Rotation into growth/AI tech amid inflation worries and defensive sector pullback.

III. Technical Breadth & Sentiment Check

The market internals remained broadly supportive despite a red day:

Advancers lagging vs decliners on Nasdaq

McClellan Oscillator: –65.07 (weak momentum, but not panic)

VIX at 17.38 (below 20, low volatility)

Put/Call ratio at 0.83 → neutral to bullish sentiment

Stocks above 200SMA: 40.12% (healthy, but decreasing)

Market Color: Mostly green internals with a red day – a sign of underlying strength.

Weak close, but internals remain solid. No broad risk-off behavior yet.

IV. Earnings & Corporate News

Earnings kicked off with heavyweights from banking and chips:

JPMorgan: Beat on both EPS ($5.24 vs. $4.48 est) and revenue. Stock climbed.

Citigroup: Surged to 17-year high on earnings beat and $4B buyback.

Wells Fargo: Missed; stock dropped on weak consumer credit trends.

BlackRock: EPS beat, but lower fees disappointed ($94M vs. $114M est).

Nvidia ($NVDA): +4.04% on news of resumed H20 GPU sales in China.

AMD ($AMD): +6.41% after clearance to resume M1308 chip exports.

Corporate moves:

Apple to invest $500M in a US rare earths supplier.

Broadcom launched the Tomahawk Ultra chip for AI acceleration.

V. Economic Calendar Highlights

Today’s data slate is packed:

Core PPI + PPI (8:30 AM): Key inflation checks post-CPI

Crude Oil Inventories (10:30 AM)

Fed Beige Book (2:00 PM) – economic sentiment snapshot

FOMC’s Williams speaks (4:30 PM) – market may listen for policy signals

Earnings before open:

Bank of America ($BAC)

Johnson & Johnson ($JNJ)

Goldman Sachs ($GS)

ASML ($ASML)

Morgan Stanley ($MS)

PNC ($PNC)

Prologis ($PLD)

Progressive ($PGR)

After-hours:

United Airlines ($UAL)

Alcoa ($AA)

Kinder Morgan ($KMI)

VI. Interpretation & Outlook

Tuesday’s session was a classic tug-of-war between inflation anxiety and tech enthusiasm. While CPI ticked higher, it didn’t spiral. Investors responded with a tactical rotation: selling financials and defensives while doubling down on AI and chips.

Breadth remains supportive, volatility is low, and tech is leading, a bullish cocktail, even with short-term wobbles. However, inflation data today (PPI) and upcoming Fed signals could add some short-term noise.

For now, watch the earnings reactions, especially from major banks and chipmakers, as well as whether this AI-led bounce has more legs.

What to trade today:

A pullback looks likely here, a healthy pause before the next move (higher). The market showed strength, but price has returned to the breakout level, mostly held up by Tech.

I've updated my stop-loss levels. Today, my focus is on tightening setups only:

TOST, SHOP, BTU, AVGO, CCEC, CPNG, DE, CEG, DELL (carried over from yesterday’s watchlist).

Have a profitable trading day!