Trading Plan: 10 March 2022

Nasdaq gapped up (+3.60%) with above-average volumes but not higher than the day before. Some growth / Technology stocks rebounded nicely yesterday and helped the index move higher as well. The price is still under the main averages. Watching the marked levels: 13850 and 12700. To talk about a constructive base, the 12700 level must hold.

SP-500 closed higher with important volumes, but it is difficult to find the trend as many rotations are taking place. Is this a double bottom pattern?! Watch the higher low level from Tuesday (4158) and the recent high (4417). Anyway, a close above the EMA21 will be a good starting point.

In the news

Oil drops 12% for the worst day since November as wild ride triggered by Russia disruption continues.

Amazon announces a 20-for-1 stock split and $10 billion buyback.

White House issues executive order on regulating cryptocurrencies.

NFTs entered mainstream consciousness in a big way, with celebrities and major companies increasingly warming to the market.

Sectors

Best yesterday sector: Technology, then Communication Services. Worst sector: Energy.

Best weekly sector: Utilities, then Energy. Worst sector: Consumer Cyclical.

Best monthly sector: Basic Materials, then Energy. Worst sector: Consumer Cyclical.

Sentiment

NAAIM (weekly, neutral between 70 and 90): 42.58

VIX (neutral under 20): 32.45

Equity Put / Call Ratio (neutral between 0.7 and 1): 1.14

CNN Fear & Greed: 17 (Extreme Fear)

Breadth

Stocks above SMA40 (neutral between 30 and 80): 36.87%

Stocks above SMA200 (neutral above 30): 30.67%

Number of stocks that increased yesterday by more than 4%: 693

Number of stocks that decreased yesterday by more than 4%: 58

Earnings Reports

CrowdStrike soared 12.5% in extended trading after beating on the top and bottom lines, and raising guidance. Revenue grew 63% YoY. Asana plunged 18% as its losses more than doubled.

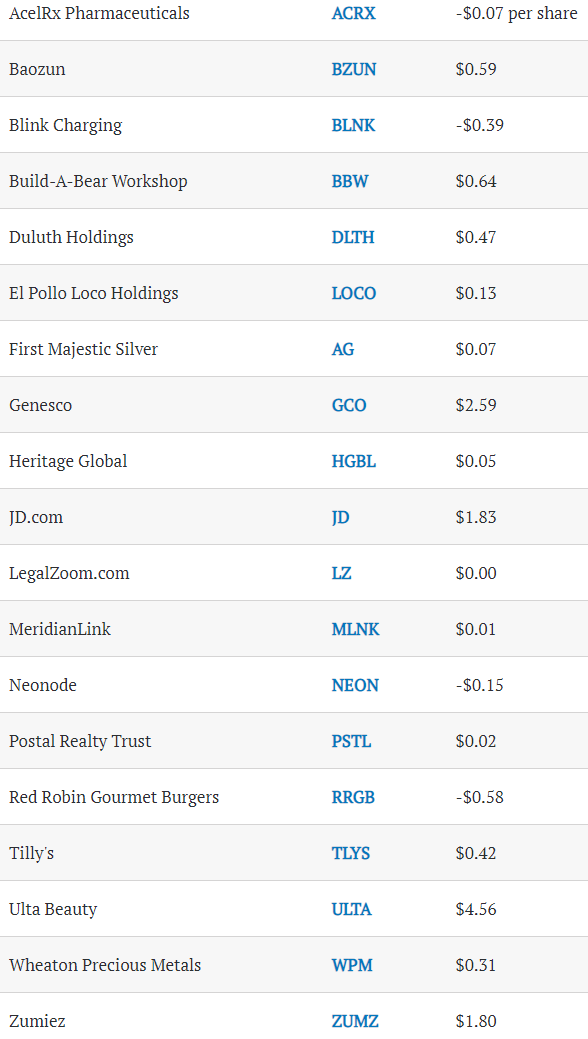

Noteworthy earnings reports for today:

Oracle ($ORCL) stock hit a record high of $103.65 in mid-December after the enterprise software provider reported top-and bottom-line beats in its fiscal second quarter. Consensus estimates are for earnings of $1.18 per share (+1.7% YoY) and revenue of $10.5 billion (+4.0% YoY).

Rivian Automotive ($RIVN) had a red-hot start after its November initial public offering (IPO), but the electric-vehicle maker quickly stalled out. Wall Street pros are projecting $60.03 million. For reference, RIVN posted a per-share loss of $12.21 on $1 million in sales in its third quarter.

What to trade today

Hard to say if yesterday's price action was a reversal or just a relief rally. All these big candles (both red and green) on the daily chart are not good for finding low-risk entries.

If trading, please consider using small positions and at tighter Stop Loss.

Tesla ($TSLA) tried a few times to pass the upper channel line. If succeeded, the trade might work. Stop Loss: 3-4%.

Sunrun ($RUN) has a wide range bar igniting from the SMA50 and yesterday a constructive retracement. If volumes come in and the price reaches again yesterday high, the trade might work. Stop Loss at yesterday low.

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.

I have exciting news to share: You can now read Wall Street Trader in the new Substack app for iPhone.

With the app, you’ll have a dedicated Inbox for my Substack and any others you subscribe to. New posts will never get lost in your email filters or stuck in spam. Longer posts will never cut-off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.

The Substack app is currently available for iOS. If you don’t have an Apple device, you can join the Android waitlist here.